Research & Insights

Atlas Capital Team is a FinTech company dedicated to addressing critical threats to global economic security. Since our founding in 2015, we have collaborated with policymakers—including Presidential administrations—along with industry leaders and academics, to investigate key vulnerabilities within the U.S. and global financial ecosystem.

Atlas was not built overnight. It emerged from a multi-year research process, guided by a deep understanding of monetary history and the lessons learned from the most defining crises in American financial life. Before we designed the architecture of a digital currency system or issued our first investment product, we asked a simple but powerful question: What makes financial systems last?

Atlas is more than a platform—it is a product of intellectual rigor and strategic foresight. Every feature, every asset class, every token was built with a singular goal: to ensure that investors, institutions, and nations have access to a financial system strong enough to endure volatility, yet flexible enough to lead the future.

We do not believe financial systems should be reactive. They should be anticipatory.

And that’s what Atlas represents—a next-generation financial infrastructure born from a deep, historical understanding of what it takes to secure prosperity, rebuild trust, and adapt to the world’s most urgent challenges.

Disruption as a Catalyst for Innovation

Throughout U.S. history, every meaningful financial breakthrough has been forged in response to systemic risk. From Hamilton’s First Bank to the Bretton Woods system, American leaders have responded to existential challenges—war, debt, disintegration, global uncertainty—not with retreat, but with institutional reinvention.

Following this blueprint, we studied how national crises were transformed into moments of monetary innovation—where public-private collaboration built tools that restored trust, resilience, and long-term prosperity.

This research is not theoretical. It was essential to our design decisions. We knew that to build a system worthy of anchoring national economic renewal, we had to understand the struggles of the past—and the solutions that evolved us.

Read more about the opportunities presented by transformational periods in our history.

Designed for the Challenges of Today

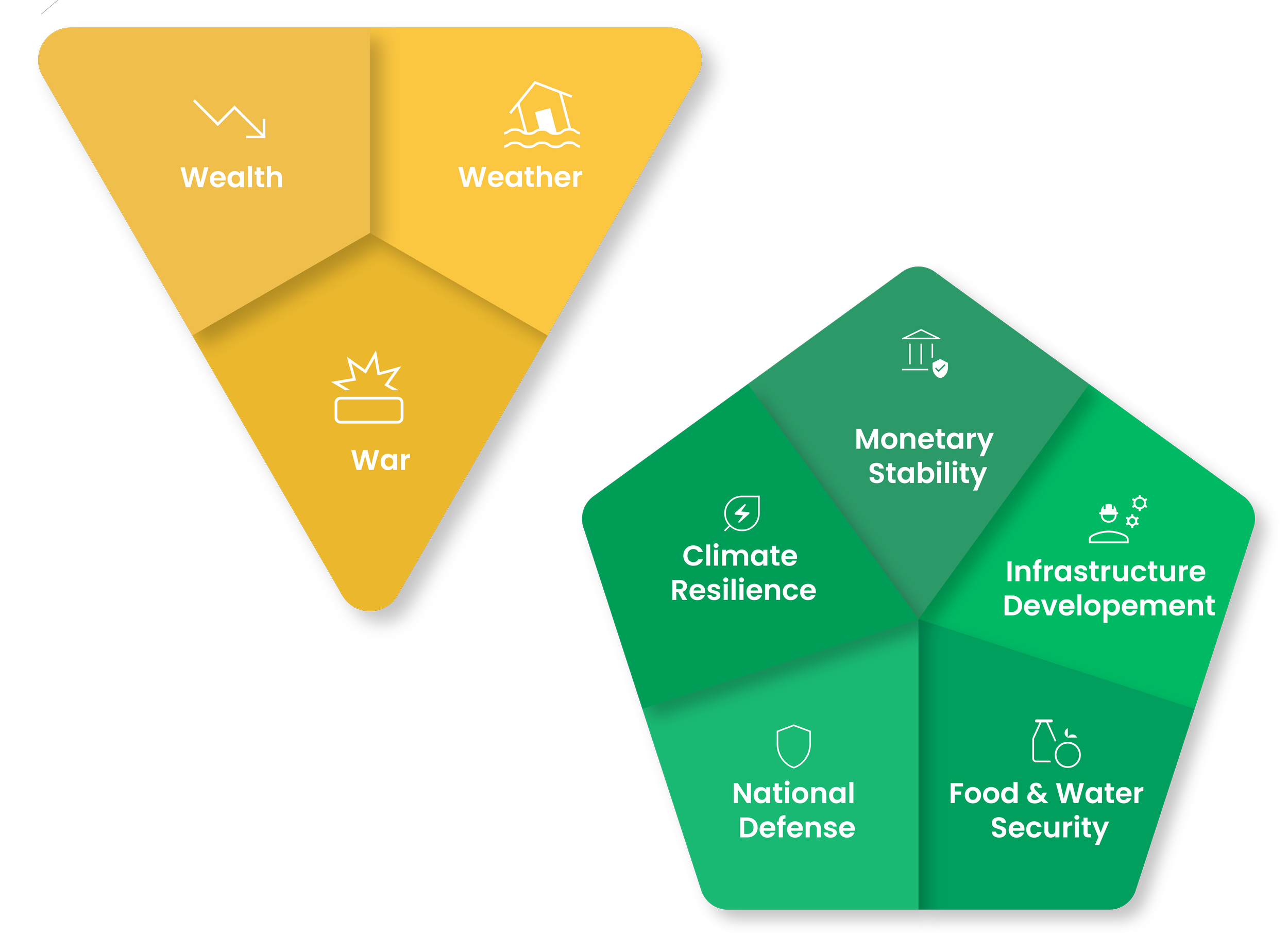

In an increasingly volatile world, three interconnected megathreats—wealth deterioration, extreme weather, and the risk of war—pose profound challenges to global stability. These threats in turn inform a set of actionable priorities, which are the foundations of our thematic investment strategy.

Megathreats

-

Wealth erosion through inflation, fiscal mismanagement, and currency debasement represents a mounting threat to economic stability. A disorderly dollar devaluation, triggered by a loss of confidence in U.S. fiscal and monetary policies, could have far-reaching consequences: skyrocketing import costs, reduced purchasing power, and declining demand for dollar-denominated assets.

-

Climate change is rapidly altering the global economic landscape. Rising sea levels, extreme weather events, and prolonged droughts are driving population displacements and placing unprecedented pressure on critical infrastructure. These shifts challenge communities, industries, and economies to adapt to an increasingly unstable environment.

-

The risk of direct geopolitical conflict between great powers has become the most urgent threat of all. While the impacts of inflation and climate change intensify, escalating tensions heighten the danger of large-scale warfare. Beyond the devastation of direct combat, war produces secondary crises, including environmental damage from the mass production of weapons and the immense costs of reconstruction.

By combining our asset-backed investment strategy, a yield-enhanced digital instrument, and fully a collateralized stablecoins, Atlas is building a financial ecosystem designed to protect investor capital, enable sovereign realignment, and reinforce the economic leadership of the United States.

Actionable Priorities

-

Transition the U.S. dollar toward a stable, asset-backed system without triggering market disruption or investor panic.

-

Accelerating resilient, sustainable infrastructure with expert-driven strategies and efficient resources. Public-private collaboration ensures scale, speed, and impact.

-

Ensuring reliable access to food and water through resilient agricultural systems, efficient resource management, and innovative technologies.

-

Strengthening economic resilience and critical systems to mitigate risks from resource competition, supply chain disruptions, and geopolitical conflict.

-

Building sustainable, adaptive communities to accommodate climate-driven mass migration, ensuring stability amid extreme weather, rising seas, and resource shifts.

Read more about how Atlas responds to real economic threats with a product stack that combines TradFi and DeFi, in our whitepaper

National Security Risks Posed by the Economy: Disorderly Dollar Devaluation

“For me, geopolitical issues are becoming more important, because how can you understand economy if you don't understand geopolitics?”

— Nouriel Roubini

The U.S. dollar’s status as the world’s reserve currency is increasingly strained, raising the risk of a disorderly devaluation—a rapid, market-driven decline beyond policymakers’ control. Confidence in fiscal and monetary stability is eroding, accelerating this risk even without major shifts in dollar supply.

History shows that economic stability is shaped by both policy decisions and deep-rooted structural constraints. While policymakers can enact short-term measures—such as stimulus, low interest rates, or interventionist strategies—these fixes have often compounded long-term imbalances. The U.S. monetary system, shaped by decades of deficit spending and global dollar dependence, is now at a point where traditional policy tools offer diminishing returns. The collapse of Bretton Woods in the 1970s demonstrated that once confidence erodes, even aggressive intervention may be insufficient to prevent economic disruption and wealth deterioration.

Preserving the dollar’s global role requires proactive solutions:

asset-backed stability mechanisms and transparent monetary frameworks. Read more in our policy brief.

Climate Adaptation: Necessities, Realities,

and Practicalities

As climate patterns shift, traditional response models are showing signs of strain, struggling to keep pace with rising risks. Extreme weather events are intensifying, and insurers are increasingly limiting coverage or withdrawing from high-risk regions. Rather than relying on reactive disaster response, Atlas prioritizes proactive climate adaptation.

Our approach focuses on strengthening resilience through strategic infrastructure investment, geographic risk assessment, and public-private collaboration. Using advanced climate modeling, we identify and prioritize regions suited for sustainable long-term development while mitigating exposure to high-risk areas. This is more than risk management—it is a strategic commitment to fostering stability, safeguarding resources, and ensuring that communities are positioned to adapt and thrive in an evolving environment.

Read the Atlas Climate Adaptation Policy Brief to learn more about our climate resiliency outlook.

Atlas Climate Response Framework

Modern Conflict and Economic Resilience

In an analysis conducted in 2015 by Atlas' founder & CEO for Provence Capital, a development venture capital firm that supports local economic activity in EMs and high-risk or post-conflict regions - specializing in scalable, tech-enabled infrastructure projects that promote socio-economic empowerment, transparency, and sustainable development. Many of the conflict dynamics persist a decade later, affecting global economies and driving us to explore resiliency based solutions.

Explore this comprehensive analysis of global conflicts from 2015, through the lens of a redefined DEFCON system that focuses on economic warfare, cyber attacks, and covert operations, rather than traditional military confrontation. It additionally presents a forward-looking strategy for post-conflict reconstruction through a proposed infrastructure fund that would leverage high-tech, scalable solutions in areas affected by these modern forms of conflict.

The Complex Struggle Between Russia and Ukraine in Eastern Europe

Russia uses territorial control, energy leverage, and gold reserves to resist NATO expansion and counter Western sanctions, while deepening ties with China.

Ukraine responds through Western alignment, seeking EU/NATO integration, international backing, and military aid.

The U.S. and NATO impose sanctions to weaken Russia and provide arms support Ukraine.

China capitalizes on the crisis, offering Russia economic support and securing favorable resource deals.

Saudi Arabia & Iran:

Middle East Power Rivalry

The power struggle between Saudi Arabia and Iran significantly impacts global energy prices, influencing transportation costs, inflation, alternative energy investments, and the stability of oil-dependent economies.

Saudi Arabia uses oil overproduction as a geopolitical lever to undercut U.S. shale, stall green energy momentum, and financially pressure rivals like Iran and Russia—while deepening nuclear ties through its alliance with Pakistan.

Iran counters through regional destabilization and diplomatic recalibration, threatening key trade routes, backing proxy groups, and seeking renewed ties with Western powers to offset Saudi influence.